Financing Futures: The Rise of Remote Mortgage Careers

Introduction

Mortgage remote jobs have become increasingly popular in recent years, providing professionals in the mortgage industry with the opportunity to work from anywhere while still making a significant impact on people’s lives. With the advancement of technology and the growing acceptance of remote work, mortgage companies are now offering a wide range of positions that can be performed remotely. In this article, we will explore various mortgage remote job opportunities, highlighting the benefits and requirements of each role, and help you find the perfect fit for your skills and aspirations.

Mortgage Remote Job Opportunities

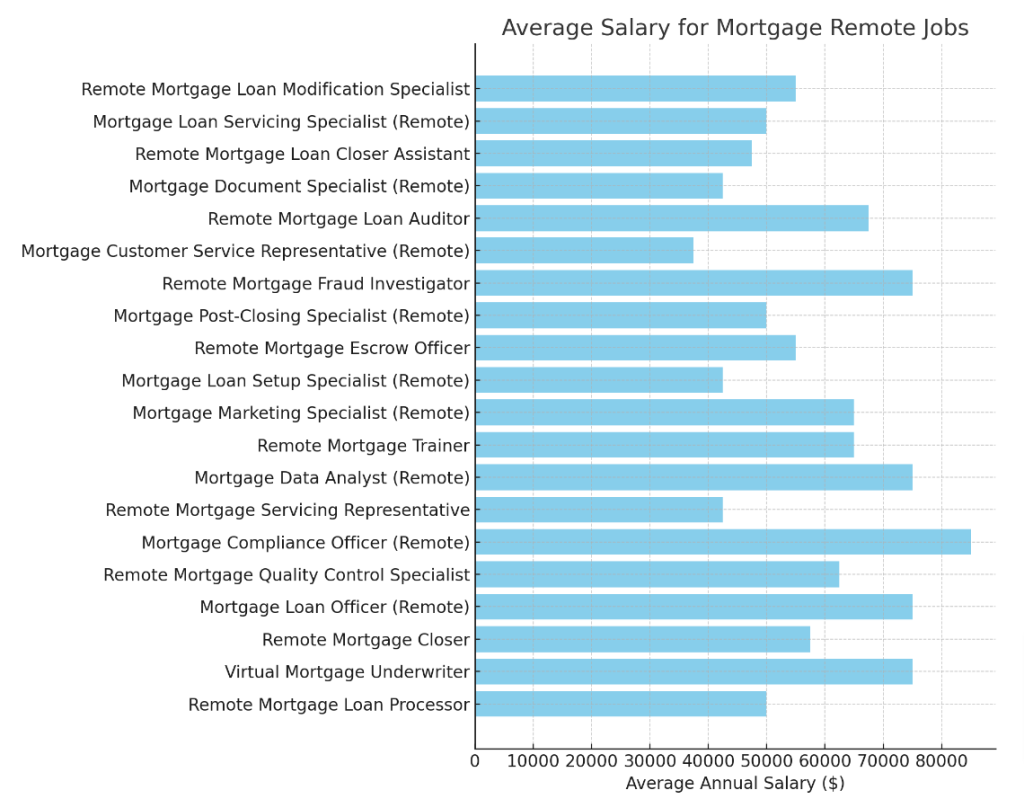

- Remote Mortgage Loan Processor

- Job Description: Review and process mortgage loan applications, gather and verify required documentation, and ensure compliance with lending guidelines.

- Requirements: Knowledge of mortgage lending processes, attention to detail, and proficiency in mortgage software. Previous experience in loan processing is a plus.

- Estimated Salary: $40,000-$60,000/year

- Benefits: Flexible work schedule, opportunities for career growth, and the ability to help people achieve their homeownership dreams.

- Virtual Mortgage Underwriter

- Job Description: Analyze mortgage loan applications, assess borrower creditworthiness, and make lending decisions based on risk assessment and guidelines.

- Requirements: Strong analytical skills, knowledge of underwriting guidelines, and the ability to make sound decisions. Relevant certifications (e.g., NMLS) are beneficial.

- Estimated Salary: $60,000-$90,000/year

- Benefits: Competitive salary, opportunities for advancement, and the chance to work with a diverse range of loan products.

- Remote Mortgage Closer

- Job Description: Coordinate the closing process of mortgage loans, prepare and review closing documents, and ensure a smooth and timely closing.

- Requirements: Knowledge of mortgage closing procedures, attention to detail, and excellent communication skills. Previous experience in mortgage closing is preferred.

- Estimated Salary: $45,000-$70,000/year

- Benefits: Flexible work arrangements, opportunities for skill development, and the satisfaction of helping borrowers complete their homeownership journey.

- Mortgage Loan Officer (Remote)

- Job Description: Generate leads, build relationships with potential borrowers, and guide them through the mortgage loan application process.

- Requirements: Strong sales and communication skills, knowledge of mortgage products, and the ability to build trust with clients. NMLS license is required.

- Estimated Salary: $50,000-$100,000/year (plus commissions)

- Benefits: Uncapped earning potential, flexible work hours, and the rewarding experience of helping people achieve their financial goals.

- Remote Mortgage Quality Control Specialist

- Job Description: Review and audit closed mortgage loan files to ensure compliance with lending guidelines, identify discrepancies, and recommend corrective actions.

- Requirements: Knowledge of mortgage lending regulations, attention to detail, and strong analytical skills. Previous experience in quality control or mortgage lending is preferred.

- Estimated Salary: $50,000-$75,000/year

- Benefits: Opportunity to ensure the integrity of the mortgage lending process, flexible work schedule, and potential for career growth.

- Mortgage Compliance Officer (Remote)

- Job Description: Ensure the mortgage company’s compliance with federal and state regulations, develop and implement compliance policies, and provide guidance to teams.

- Requirements: In-depth knowledge of mortgage lending laws and regulations, strong communication skills, and the ability to stay current with regulatory changes.

- Estimated Salary: $70,000-$100,000/year

- Benefits: Opportunity to make a significant impact on the company’s compliance efforts, competitive salary, and the potential for leadership roles.

- Remote Mortgage Servicing Representative

- Job Description: Assist mortgage borrowers with account inquiries, payment processing, and loan modifications. Provide excellent customer service and resolve issues promptly.

- Requirements: Strong customer service skills, knowledge of mortgage servicing processes, and the ability to handle sensitive financial information.

- Estimated Salary: $35,000-$50,000/year

- Benefits: Flexible work arrangements, opportunities for skill development, and the chance to make a positive impact on borrowers’ financial well-being.

- Mortgage Data Analyst (Remote)

- Job Description: Analyze mortgage data to identify trends, assess risk, and provide insights to support business decisions. Develop reports and dashboards to communicate findings.

- Requirements: Strong analytical skills, proficiency in data analysis tools (e.g., Excel, SQL), and the ability to translate data into actionable insights.

- Estimated Salary: $60,000-$90,000/year

- Benefits: Opportunity to work with large datasets, influence business strategies, and enjoy a flexible work environment.

- Remote Mortgage Trainer

- Job Description: Develop and deliver training programs for mortgage professionals, including loan officers, processors, and underwriters. Utilize e-learning platforms and virtual training sessions.

- Requirements: Knowledge of mortgage lending processes, excellent communication skills, and the ability to create engaging training content.

- Estimated Salary: $50,000-$80,000/year

- Benefits: Opportunity to shape the skills and knowledge of mortgage professionals, flexible work arrangements, and the potential for career growth in learning and development.

- Mortgage Marketing Specialist (Remote)

- Job Description: Develop and execute marketing strategies to promote mortgage products, generate leads, and build brand awareness. Utilize digital marketing channels and analyze campaign performance.

- Requirements: Strong marketing skills, knowledge of mortgage products, and proficiency in digital marketing tools. Experience in the mortgage industry is a plus.

- Estimated Salary: $50,000-$80,000/year

- Benefits: Opportunity to showcase creativity, work with a variety of marketing channels, and contribute to the growth of the mortgage business.

To apply for any of these jobs or similar positions, click here.

What People Say

“Working as a remote mortgage loan processor has been a game-changer for me. I enjoy the flexibility to balance my work and personal life while still making a meaningful impact on people’s homeownership journeys. The company provides excellent training and support, and the salary is competitive. The only challenge is the occasional high volume of applications, but with good time management skills, it’s manageable.”

Aspen Whitmore, Telluride, Colorado

“Being a virtual mortgage underwriter has allowed me to utilize my analytical skills and make sound lending decisions from the comfort of my home. The company invests in cutting-edge technology, making the remote work experience seamless. The salary and benefits package is attractive, and there are opportunities for growth. The main challenge is staying up-to-date with ever-changing guidelines, but the company provides regular training and support.”

Sienna Hartwell, Marfa, Texas

“Working remotely as a mortgage closer has been a rewarding experience. I enjoy the satisfaction of helping borrowers complete their homeownership journey and the flexibility to work from anywhere. The salary is competitive, and the company provides a supportive team environment. The only downside is the occasional pressure to meet tight closing deadlines, but with good communication and organization, it’s manageable.”

Jasper Kinsley, Paia, Hawaii

“Being a remote mortgage quality control specialist has allowed me to ensure the integrity of the lending process while enjoying the benefits of working from home. The company values attention to detail and provides ongoing training to keep us updated with regulations. The salary is fair, and the work-life balance is excellent. The main challenge is the meticulous nature of the work, but it’s a small price to pay for the satisfaction of maintaining quality standards.”

Luna Rothschild, Mystic, Connecticut

“Working as a remote mortgage servicing representative has been a fulfilling experience. I enjoy the opportunity to assist borrowers with their accounts and provide solutions to their concerns. The company offers a competitive salary and a supportive team environment. The main challenge is handling difficult customer situations, but with empathy and problem-solving skills, it’s manageable. The flexibility to work from home is a significant advantage.”

Caspian Ellington, Bath, England

More Remote Mortgage Jobs

- Mortgage Loan Setup Specialist (Remote)

- Job Description: Review and set up new mortgage loan files, ensure accuracy and completeness of documentation, and prepare files for processing.

- Requirements: Knowledge of mortgage loan documentation, attention to detail, and proficiency in mortgage software. Previous experience in loan setup is a plus.

- Estimated Salary: $35,000-$50,000/year

- Benefits: Flexible work schedule, opportunities for skill development, and the chance to be part of the initial stages of the mortgage lending process.

- Remote Mortgage Escrow Officer

- Job Description: Manage escrow accounts for mortgage borrowers, process property tax and insurance payments, and handle escrow analysis and disbursements.

- Requirements: Knowledge of escrow processes, attention to detail, and strong customer service skills. Previous experience in escrow or mortgage servicing is preferred.

- Estimated Salary: $45,000-$65,000/year

- Benefits: Opportunity to ensure the accurate management of escrow funds, flexible work arrangements, and potential for career growth.

- Mortgage Post-Closing Specialist (Remote)

- Job Description: Review and audit mortgage loan files after closing, ensure compliance with investor guidelines, and coordinate with teams to resolve discrepancies.

- Requirements: Knowledge of mortgage post-closing procedures, attention to detail, and strong problem-solving skills. Previous experience in mortgage post-closing is a plus.

- Estimated Salary: $40,000-$60,000/year

- Benefits: Opportunity to ensure the quality and compliance of closed loans, flexible work schedule, and potential for skill development.

- Remote Mortgage Fraud Investigator

- Job Description: Investigate potential fraud in mortgage loan applications, conduct research, and collaborate with teams to mitigate fraud risks.

- Requirements: Knowledge of mortgage fraud schemes, strong investigative skills, and the ability to analyze complex financial information. Previous experience in fraud investigation is preferred.

- Estimated Salary: $60,000-$90,000/year

- Benefits: Opportunity to protect the integrity of the mortgage lending process, competitive salary, and the potential for career growth in fraud prevention.

- Mortgage Customer Service Representative (Remote)

- Job Description: Provide exceptional customer service to mortgage borrowers, answer inquiries, and assist with account management. Resolve customer concerns promptly and efficiently.

- Requirements: Strong customer service skills, knowledge of mortgage products and processes, and the ability to communicate effectively with borrowers.

- Estimated Salary: $30,000-$45,000/year

- Benefits: Flexible work arrangements, opportunities for skill development, and the chance to make a positive impact on borrowers’ experience.

- Remote Mortgage Loan Auditor

- Job Description: Conduct internal audits of mortgage loan files, assess compliance with policies and regulations, and provide recommendations for process improvements.

- Requirements: Knowledge of mortgage lending regulations, strong analytical skills, and attention to detail. Previous experience in mortgage auditing or quality control is preferred.

- Estimated Salary: $55,000-$80,000/year

- Benefits: Opportunity to ensure the integrity and compliance of mortgage lending practices, flexible work schedule, and potential for career growth in risk management.

- Mortgage Document Specialist (Remote)

- Job Description: Review and prepare mortgage loan documents, ensure accuracy and completeness, and coordinate with teams to obtain missing information.

- Requirements: Knowledge of mortgage loan documentation, attention to detail, and strong organizational skills. Previous experience in mortgage documentation is a plus.

- Estimated Salary: $35,000-$50,000/year

- Benefits: Flexible work arrangements, opportunities for skill development, and the chance to play a vital role in the mortgage loan process.

- Remote Mortgage Loan Closer Assistant

- Job Description: Assist mortgage loan closers with the preparation and review of closing documents, coordinate with title companies and borrowers, and ensure timely closings.

- Requirements: Knowledge of mortgage closing procedures, attention to detail, and strong communication skills. Previous experience in mortgage closing is preferred.

- Estimated Salary: $40,000-$55,000/year

- Benefits: Opportunity to learn and grow in the mortgage closing process, flexible work schedule, and the chance to contribute to successful loan closings.

- Mortgage Loan Servicing Specialist (Remote)

- Job Description: Handle mortgage loan servicing tasks, including payment processing, escrow management, and borrower inquiries. Ensure accurate and timely servicing of loans.

- Requirements: Knowledge of mortgage loan servicing processes, strong attention to detail, and excellent customer service skills. Previous experience in loan servicing is a plus.

- Estimated Salary: $40,000-$60,000/year

- Benefits: Flexible work arrangements, opportunities for skill development, and the chance to contribute to the smooth operation of mortgage loan servicing.

- Remote Mortgage Loan Modification Specialist

- Job Description: Assist borrowers with mortgage loan modification requests, evaluate eligibility, and coordinate with teams to implement approved modifications.

- Requirements: Knowledge of mortgage loan modification programs, strong communication skills, and the ability to handle sensitive financial situations. Previous experience in loan modification is preferred.

- Estimated Salary: $45,000-$65,000/year

- Benefits: Opportunity to help borrowers in need, flexible work schedule, and the chance to make a positive impact on people’s financial well-being.

To apply for any of these jobs or similar positions, click here.

Conclusion

Mortgage remote jobs offer a world of exciting opportunities for professionals seeking flexibility, growth, and the chance to make a difference in people’s lives. From loan processing and underwriting to quality control and customer service, there is a wide range of roles that can be performed remotely in the mortgage industry. With competitive salaries, benefits, and the ability to work from anywhere, mortgage remote jobs provide a compelling career path for those passionate about the housing finance sector.

To stay informed about the latest mortgage remote job openings and industry trends, we invite you to join our email list. By subscribing, you’ll receive regular updates on new job postings, expert insights, and valuable resources to help you navigate your mortgage career journey. Whether you’re a seasoned professional or just starting out, our curated content will keep you inspired and empowered to take your career to new heights.

Don’t miss out on the exciting world of mortgage remote jobs. Sign up for our email list today and unlock a world of opportunities that combine the rewards of helping people achieve their homeownership dreams with the flexibility and convenience of remote work. Your dream mortgage career awaits!