Financial Mastery for Live Chat Pros: Building Your Financial Future

Financial talk can be tricky, especially when you’re a live chat professional aiming to grow your income. Live chat experts are now key players in the online business world, offering valuable advice and service support.

This article will guide you through crafting a financial plan that boosts client satisfaction while securing your financial future. Dive in to turn chats into checks!

Key Takeaways

- Live chat professionals can boost client trust and satisfaction by understanding and addressing their financial needs in real-time conversations.

- A comprehensive financial plan for live chat experts should include a balance sheet, emergency budgeting, retirement planning, tax strategies, and investment plans.

- Regular review and updates of the financial plan are essential to align with changing goals and circumstances for sustained progress toward financial objectives.

- Using tools like LivePlan simplifies creating budgets, forecasts, tracking performance while enabling collaboration with clients on their finances.

- Ongoing support and guidance from live chat professionals strengthen long – term relationships with clients aiming for financial stability.

Benefits of Creating a Financial Plan as a Live Chat Professional

Creating a financial plan as a live chat professional can lead to improved understanding of clients’ financial needs and increased trust, ultimately leading to long-term client relationships.

It also provides personal financial stability for the professional.

Improved understanding of clients’ financial needs

Understanding your clients’ financial needs is crucial for offering top-notch service. As a live chat professional, engaging in real-time conversations helps you pick up on key details that can guide your financial planning advice.

You get to learn about their income streams, budget concerns, and long-term goals like retirement or investing in a small business. Using this knowledge enables you to tailor strategies specifically designed to meet those unique needs.

By mastering client engagement through live chat, you foster trust by showing genuine interest and understanding of their financial situations. This sets the stage for creating personalized plans that truly resonate with clients’ ambitions and challenges.

Next up: discovering how fostering increased trust leads to stronger long-term client relationships.

Increased trust and long-term client relationships

Creating a financial plan as a live chat professional isn’t just about the numbers; it builds stronger bonds with clients. This personal touch goes beyond basic client engagement. It shows you’re committed to their long-term success, which can turn one-time customers into loyal clients who trust your guidance for years to come.

By consistently applying expert advice and demonstrating your investment in their financial goals, you foster an environment where trust flourishes.

Long-term client relationships hinge on reliability and transparency. Your role in regularly updating their financial plans with proactive strategies reinforces that trust. Live chat provides an immediate platform for discussing updates or concerns, making your services integral to their wealth management journey.

Such interactions pave the way for ongoing support that adapts to life’s changes, thereby solidifying those all-important client-professional bonds.

Personal financial stability

Attaining personal financial stability allows live chat professionals to focus more intently on their client’s needs without the distraction of their own financial concerns. It acts as a solid foundation for developing quality relationships with clients who seek professional advice.

A secure financial position inspires confidence and competence, traits that clients look for when entrusting someone with their business or personal finances.

As you navigate your path towards financial independence, it’s critical to adopt strategic planning methods like budgeting, investing, and wealth management. These practices help safeguard against unexpected expenses and ensure an ongoing income stream.

By applying the same principles you recommend to clients in managing risks and planning for retirement, you reinforce the practicality of your advice through firsthand success stories.

This not only bolsters credibility but also demonstrates a commitment to industry best practices in personal and business financial planning.

Components of a Comprehensive Financial Plan

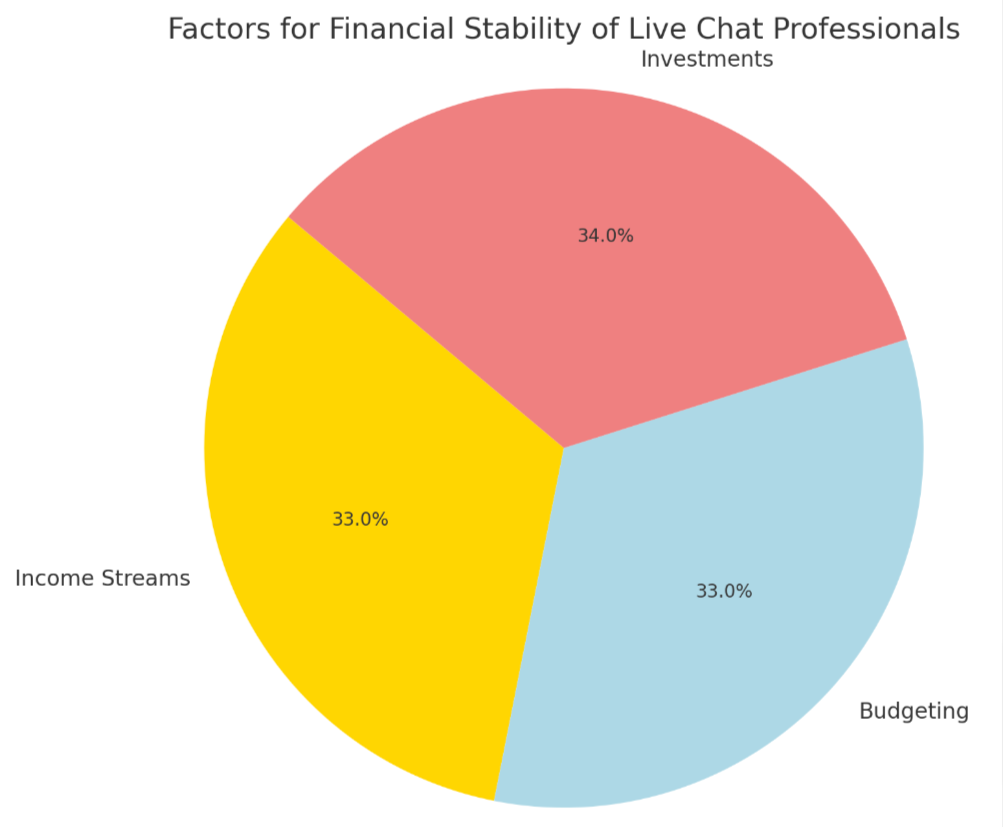

To ensure a comprehensive financial plan, consider factors such as balance sheet, emergency budgeting, retirement planning, tax strategies and investment plans. Each component plays a crucial role in creating a solid foundation for your financial stability.

Balance Sheet

A Balance Sheet is a financial snapshot that summarizes a live chat professional’s assets, liabilities, and equity at a specific point in time. It’s a critical component for creating a comprehensive financial plan. Below is an example of what a Balance Sheet might look like:

| Balance Sheet as of [Date] | |

|---|---|

| Assets | Amount |

| Cash and Cash Equivalents | $[Amount] |

| Accounts Receivable | $[Amount] |

| Personal Property | $[Amount] |

| Investments | $[Amount] |

| Total Assets | $[Total Assets Amount] |

| Liabilities | Amount |

| Credit Card Debt | $[Amount] |

| Loans | $[Amount] |

| Mortgage | $[Amount] |

| Total Liabilities | $[Total Liabilities Amount] |

| Equity | Amount |

| Retained Earnings | $[Amount] |

| Total Equity | $[Total Equity Amount] |

| Total Liabilities and Equity | $[Total Liabilities and Equity Amount] |

This table represents assets, the valuable items you own, against liabilities, what you owe, resulting in the equity, which is your net worth. Regularly updating your Balance Sheet helps track financial progress and informs decision-making.

Budget for emergencies

After assessing the balance sheet, it is crucial for live chat professionals to include a budget for emergencies in their financial planning. This ensures financial stability and security during unexpected events or crises.

- Identify Potential Emergencies: Anticipate scenarios such as medical expenses, car repairs, or sudden unemployment that could impact finances.

- Calculate Emergency Fund: Determine the amount needed to cover 3-6 months of living expenses in case of unforeseen circumstances.

- Allocate Monthly Contributions: Set aside a specific portion of income each month to gradually build the emergency fund.

- Separate Emergency Funds: Keep the emergency funds separate from daily spending accounts to avoid misuse.

- Review and Adjust: Regularly review the emergency budget and adjust as necessary based on changes in living expenses or income.

Retirement planning

When creating a financial plan as a live chat professional, retirement planning is an essential component. This involves assessing current and future income streams, considering investment strategies for long-term financial stability, and exploring options for tax planning to maximize retirement savings.

To support clients in their retirement planning, it’s crucial to offer professional advice on managing finances during their post-career years. By integrating retirement planning into the overall financial plan, live chat professionals can help clients achieve their long-term financial goals and secure a comfortable retirement.

Tax planning

When creating a financial plan as a live chat professional, it’s crucial to incorporate tax planning. This involves assessing the tax implications of various financial decisions, identifying potential opportunities for tax savings, and ensuring compliance with tax regulations to optimize your clients’ financial outcomes.

By proactively integrating tax planning into your financial strategies, you can help your clients minimize their tax liabilities while maximizing their overall financial wellbeing.

Moving on to “Investment Strategies”, let’s explore how you can assist your clients in making informed investment decisions that align with their long-term financial goals.

Investment strategies

Implementing effective investment strategies is crucial for achieving long-term financial goals. Diversifying your portfolio across different asset classes such as stocks, bonds, and real estate can help manage risk and optimize returns.

Regularly reviewing and adjusting your investments based on market conditions and personal financial objectives is essential to ensure your portfolio remains aligned with your overall financial plan.

Maximizing tax-efficient investment vehicles like 401(k) plans, IRAs, or health savings accounts can enhance your wealth accumulation while minimizing tax liabilities. Utilizing the expertise of a qualified financial advisor ensures that you stay informed about market trends, potential investment opportunities, and any necessary adjustments to achieve your desired outcomes in alignment with your comprehensive financial plan.

How to Create a Financial Plan as a Live Chat Professional

Evaluate the current and future financial needs of your clients to identify areas for improvement. Assist clients in setting realistic and achievable financial goals, and utilize financial management software to keep track of progress.

Evaluate current and future financial needs

Assess your current income and expenses to understand your financial standing. Consider future needs like retirement, emergency funds, or potential investments. Set clear financial goals based on this evaluation to plan effectively for the future.

Determine the best strategies to allocate resources and maximize savings. Utilize effective financial management tools and seek professional advice when needed. By analyzing both current and upcoming financial requirements, you can craft a comprehensive plan that ensures long-term stability.

Next, we’ll explore how live chat professionals can assist clients in setting these critical financial goals.

Assist clients in setting financial goals

Guide clients in establishing clear and achievable financial objectives that align with their long-term aspirations and short-term needs. Encourage them to consider various aspects such as retirement, emergency funds, and investment targets while providing personalized support tailored to their unique situations.

Facilitate open discussions to help clients understand the importance of setting attainable financial milestones, empowering them to take control of their financial future.

Support customers in identifying specific and measurable financial goals by leveraging effective questioning techniques. Collaborate with individuals to outline realistic timelines for achieving these targets, ensuring that they remain motivated throughout the financial planning process.

Utilize financial management software

Implement financial management software to streamline client analysis and budgeting. Leverage the tools for efficient retirement planning and investment strategies, enabling you to provide personalized financial advice.

Stay updated with real-time tracking of income streams and expense management, ensuring ongoing support for clients’ long-term financial goals.

Next, let’s discuss how to offer ongoing support and guidance in maintaining a successful financial plan as a live chat professional.

Maintaining a Successful Financial Plan

Regularly review and update the plan to ensure it aligns with your current financial goals, offering ongoing support and guidance as needed. Ready to learn more? Keep reading for tips on creating a comprehensive financial plan as a live chat professional!

Regularly review and update the plan

To ensure the continued success of your financial plan, set aside time each month to review and update it. Assess any changes in income or expenses, as well as shifts in your investment strategy.

This will help you stay on track with your financial goals and make any necessary adjustments to keep progressing towards them.

In addition, regularly reviewing and updating the plan allows you to adapt to any unexpected financial situations that may arise, ensuring that you are prepared for whatever comes your way.

Offer ongoing support and guidance

To ensure long-term success, live chat professionals should offer ongoing support and guidance to their clients as they navigate their financial plans. This involves providing regular check-ins, answering questions, offering advice on adjustments, and keeping the client motivated towards reaching their financial goals.

By maintaining consistent communication and support, live chat professionals can build trust with their clients and demonstrate a commitment to helping them achieve financial stability.

Utilizing resources such as LivePlan can also be beneficial in providing ongoing support by allowing live chat professionals to track progress, make real-time updates to the plan, and collaborate with clients seamlessly.

Utilize resources and tools such as LivePlan

Utilize resources and tools such as LivePlan to streamline the financial planning process. LivePlan offers easy-to-use templates for creating budgets, forecasts, and performance tracking.

It also provides features for collaborating with clients and sharing real-time financial data securely.

Analyze client’s financial position by inputting their information into LivePlan. This will allow for personalized recommendations based on their unique needs and goals. The software enables efficient management of multiple clients’ financial plans in one centralized location, making it a valuable asset for any live chat professional.

Conclusion

In summary, creating a financial plan as a live chat professional helps in understanding clients’ needs and building trust. It also ensures personal financial stability. To develop an effective plan, assess current and future needs, help clients set goals, and use financial management software.

Remember to regularly review and update the plan, offer ongoing support, and utilize resources such as LivePlan for success.